“We want more people playing more games more often”: Asmodee’s Roger Martin on UK growth plans

Roger, it’s great to catch up. To kick us off, talk us through some exciting new developments at Asmodee?

I think the best place to start is the spin-off from Embracer. It very much puts our destiny into our own hands. That should give us a confidence to get out there and grow. The mindset now is: ‘Let’s grow’, and we’ve been reigniting our M&A engine with the acquisition of the Zombicide IP announced earlier this month.

How do you approach that growth strategy for the UK?

Our vision as a UK business is that we want more people playing more games more often – and we have two goals that underpin that vision. The first goal is to be the value-added distributor to our suppliers, our retailers and our staff, and we need to work out what that means to those three stakeholders.

But then from my point of view as Marketing Director, the second key thing is to grow the market and grow within the market. As a number one player in the market, if the market grows, then we grow sufficiently as well. That also fulfils the vision of more people playing more games more often. And if you look at the German market or the French market, they are bigger markets and gaming is much more embedded in both of those cultures – but we’re not that different from them. That means we have an exciting opportunity to grow and match their size.

On that, what would you say is unique about the UK market – in terms of both challenges or opportunities?

We are much more mid-Atlantic and driven by the US than France or Germany are. One of our challenges – and it’s changing slightly but is still there – is price perception. You get a game like 6 Nimmt! – which comes in a little box – and in the UK people see a small box and think: ‘That’ll be £6.’ But in France and Germany, it’ll sell for £12 because what’s appreciated there is the value of the game that’s inside – not the physical size of the packaging. I’m trying to get that mindset changed here.

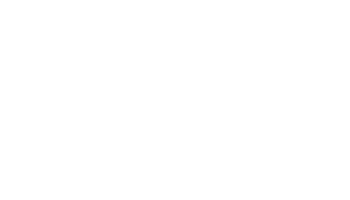

We need to appreciate the inherent value of a game. It costs £50 to take your family to the cinema on a Saturday night. That’s a one-off great memory, whereas if you have bought a copy of CATAN for £50, you’ve played a great game, you’ve had a great memory and then you can play it time and time again. So, one of the challenges in the UK market is trying to get consumers to understand that value – and how much value is wrapped up within the game itself.

Great point.

I’d also say there’s a greater willingness to experiment on new games in Germany and France. Our research shows that the biggest barrier to playing a game is learning the rules. My experience of France and Germany – when I sit down with colleagues over there or friends not in the industry – is that they’re much more willing to pick up a new game and learn it. They’ll have a go and try something new. Whereas in the UK, if we’ve got to open a rulebook, there’s a perception it’s going to be complicated. We need to help people get over that, which is why we’re investing in more demonstrations and experiential marketing. We’re putting games in people’s hands to play and we’re teaching them the rules. It’s about removing the barriers.

Do in-store experiences at retail play a part in that process too?

100%. And we have a programme now to support board game cafes. You could look at board game cafes and say: “Well, they only spend X amount with us every year compared to a retail store”, but look at why board game cafes exist… They exist to get people to play games. If we can support them more and work closer with them to introduce our games to people, they will buy that game. It might be from us, or another retailer, or from the cafe itself, but they’ll buy the game. Board game cafes have a key role to play in this.

That’s something the best board game cafes and the best hobby stores share – they feel welcoming to new players and exciting to existing players. And I imagine some cafes do that better than some hobby stores that preach to the converted.

It speaks to the professionalisation of the industry – and it’s one of the industry’s big challenges. Hobby shops tend to be in places where you have a lot cheaper rent. London and the South-East has been poorly served by hobby stores because you can’t make any money. Whereas if you’re at The Ludoquist in Croyden, they have a bar area, they do great food, they’ve got a great online presence and they’ve thought carefully about their offering. It’s about understanding the community you want to come in and visit you on a regular basis.

Absolutely. Now, Asmodee has a lot of games and different studios – does that help when it comes to engaging with an eclectic range of retailers?

It does and from a global perspective, we have three play types – Social, Tabletop and Lifestyle – because that’s where the consumers are. I would say Lifestyle is our bedrock. It’s where the company grew from – those engaged hobby stores where you go to meet like-minded people and engage with communities of gamers. That’s where the core of our market is, and as with any foundation, we need to support it, give it the right products and service them efficiently.

At the other end you’ve got Social Play, where we have games such as Just One, Dobble or Fun Facts that are competing with brands like Monopoly or companies like Big Potato. It covers those types of games that cycle in and out of fashion, as well as success stories like Dobble – and Dobble is doing extremely well.

And generally, with board games, it’s about working out where they fit best – what is the right kind of retailer for the game. Waterstones has a much-expanded collection, WHSmith has a more curated collection, as does John Lewis, and then you’ve got someone like Amazon which has a really broad range.

And I’d imagine those three verticals also speak to how you engage different types of consumer?

Absolutely. If I look at myself when I was growing up, you had board games and you had the start of computer games. All very geeky! Now, if you talk to people in their twenties or early twenties, they don’t differentiate between board gaming, mobile gaming, computer gaming, PC gaming…

It’s all just gaming?

It’s just gaming. They look at it as an entertainment experience. Do I want to play online with my mate? Do I want to play Exploding Kittens physically with someone else? With that consumer, there’s a real opportunity to bring those people into a CATAN or a Ticket to Ride as they get older. We describe ourselves as an entertainment company that specialises in tabletop gaming. That’s the psychology we need to put through in our messaging to consumers.

Going back to retail for a moment, how does Asmodee get UK buyers excited about a game?

There are lots of different ways of doing it. If you go back in the day and look at Dobble. Dobble grew through having a demo programme and demonstrating it everywhere you possibly could. Gradually over two, three, four years, you saw it grow. One of the challenges now is having the patience to invest in a game for that period of time. There are so many games coming through and the quality of these games is so much higher. But if you talk about true mass market – which for the UK is into grocers – then that’s all about conveying the instant three-second appeal. You see on the shelf, you pick it up because it’s visually appealing, you scan the back… And then you look at the price and that should be attractive too. From a grocer’s point of view, that’s what you need.

Social media also plays a part now. James Daunt – the CEO of Waterstones and Barnes & Noble – talks about BookTok.

BookTok being book-content on TikTok?

Yes – he feels BookTok has revolutionised book selling. You’ll have a Waterstones bookseller who really likes a book, so they’ll do a video on TikTok about it. Then other Waterstones booksellers from other Waterstones stores will like it and share it. Suddenly, you get this viral effect where a book liked by a bookseller in Truro can suddenly become the bestseller in a Newcastle store – all because of that network and that virality. We need to do that in the game space.

Yes, sounds like a good idea. And Waterstones have enjoyed success with their Game of the Month programme which Asmodee has been involved with, right?

It’s a great idea. Every time I’ve been to a Waterstones and asked them about the Game of the Month, there’s usually someone in the store who has played it. It speaks to what we spoke about earlier – helping consumers embrace games while bypassing those barriers.

We’ve navigated a similar opportunity with the Toymaster group. Toymaster do well with some games, but they’re quite traditional. Some members thought of games as only for Christmas, but then they’d noticed people coming in and spending money on games throughout the year, so they were keen to do more but there’s a lot of games out there and it was confusing. So, we created a map for them. It guides them to games based on questions they can ask. Is it for your family? Is it for a couple? Is it for kids? Do you want something that’s quick? The answer steers them to a game, and it helps the retailer deliver recommendations with more confidence.

Before we start to wrap up, do you think the games industry is in a good place creatively right now industry wise?

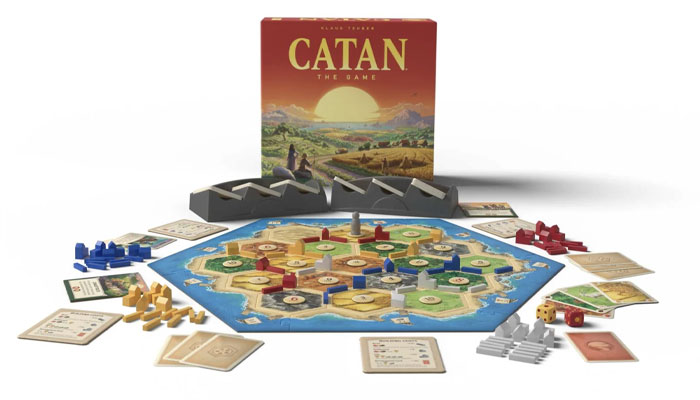

I think we’re in a good place. If you look at our most recent releases, Harmonies is a cracking game – I’ve played that over and over again. Duel for Middle-Earth is terrific. We have a really strong pipeline of titles coming through.

Now, things are tight for people at the moment, and that’s why we need to let people know that these games are a really good investment. They offer really good value. The more we can convey that message, the more the market will benefit from growth.

You mentioned earlier some of your pillar brands, and CATAN was obviously one of those – but there was a time where CATAN was considered a hobby game. At what point do you know when a game is on its way to becoming a ‘pillar’ title?

The flippant answer would be when start seeing it regularly appear in charity shops! But the more accurate answer is related to seeing our games move up the retail pyramid. You’ve got lots of games on the base. Gradually a game starts to appeal to different retailers and works up the pyramid that way. It might start doing well in Waterstones… Then it moves onto WHSmith – and then into Tesco or Sainsbury’s. Taco Cat Goat Cheese Pizza is a great example. When you look at the Circana data, you see it rising higher and higher up that list each year.

One of the challenges for us is balancing growing those pillar games – like CATAN, Ticket to Ride and Azul – with making new releases a success. With the best will in the world, we know we’re not going to sell the same volume of a new game in the UK that we will do with a Ticket to Ride. But that said, I know in three to five years’ time, we’ll still be selling Duel for Middle-Earth and Harmonies. You can tell quite quickly from the market reaction to a game whether it’s one that’s going to die fast, or start to make the way up the chain.

Last question! What’s Asmodee’s most underrated game?

I’d going to say Survive the Island – and it’ll probably be because the name has changed a bit of the 30 years that it’s been around. It’s a brilliant game and I can’t understand why it hasn’t taken off in the way that I would expect it to have done. It’s so much fun and it’s now got great artwork. So it’s got every chance to do something special now, hopefully.

It’s a favourite in our house as it happens! Great game. Roger, this has been terrific. Huge thanks again.

–

To stay in the loop with the latest news, interviews and features from the world of toy and game design, sign up to our weekly newsletter here