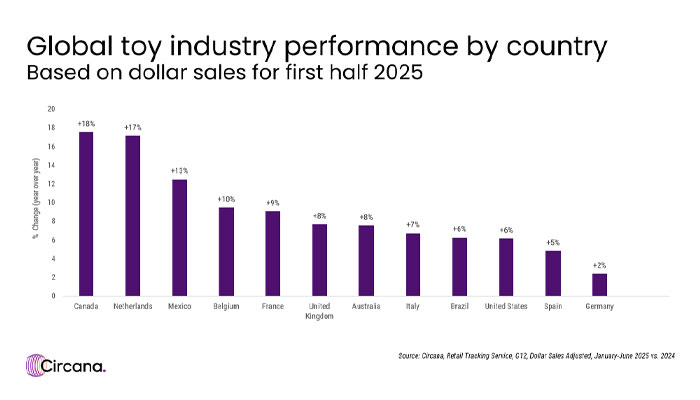

Global toy markets enjoy strong rebound in first half of 2025, reports Circana

Circana has released the toy sales performance figures for the first half of the year across 12 global markets (the G12), including Australia, Belgium, Brazil, Canada, France, Germany, Italy, Mexico, Netherlands, Spain, United Kingdom and the UK.

Across the G12, dollar sales increased by 7% from January through June 2025 to $27.5 billion, versus the same period in 2024. Units sold grew by 4%, while average selling price rose by 3%, according to Circana’s Retail Tracking Service.

“I have been following the toy market for many years and cannot recall the last time all countries Circana tracks were growing at the same time,” said Frédérique Tutt, Global Toys Industry advisor at Circana.

“The surge in sales can largely be attributed to consumers aged over 12-years-old, who have shown unprecedented growth and are consistently outperforming traditional kids’ trends. Products such as building sets, trading cards, games, plush toys, and collectibles are seeing increased demand from both teens and adults.”

So far this year, seven of the 11 toys supercategories tracked by Circana experienced year-over-year sales increases within the G12.

Games and puzzles grew the fastest, up 36%, followed by explorative and other toys up 13%, while building sets enjoyed growth of 12%. The top five gaining segments in the toy market include strategic trading card games, standard building sets, non-strategic trading card games, action figure collectibles, and action figures. Collectibles are a driving force for the toy market, with first half sales up 35% globally.

Licensed toy sales grew by 17% globally and now account for 35% of all global toy sales. Pokémon remains the top property for the fourth consecutive year, with sales doubling compared to last year. Other leading properties include the NFL, Marvel, Hot Wheels and Star Wars.

“The toy market is in healthy shape, with solid demand for toys and games; however, as an industry we must remain vigilant of the uncertainties surrounding US tariffs and their impact on pricing and supply chains,” added Tutt.

“As the second half of the year accounts for over 60% of annual toy sales, the industry has reason to be optimistic about continued growth, but must also remain cautious and strategic as the holiday season draws near.”

For the UK, the toy market was up 8% in value for YTD JUne 2025, with eight of 11 supercategories growing. The fastest growth was in games and puzzles – up 34% and driven by Pokémon cards. Building sets were up 14%, action figures grew 19% while collectibles were up 23%.

–

To stay in the loop with the latest news, interviews and features from the world of toy and game design, sign up to our weekly newsletter here